SSS Calamity Loan 2025 Eligibility Criteria and Application Process

The Social Security System (SSS) offers a Calamity Loan Program to help members recover when natural disasters strike. In 2025, SSS introduced revised guidelines to make the loan more accessible, affordable, and faster to process. This article explains in detail the eligibility criteria and application process for the SSS Calamity Loan 2025.

What Is the SSS Calamity Loan?

The SSS Calamity Loan is a short-term cash loan for members who live in areas declared under a state of calamity. It is designed to give quick financial support to families who have suffered damage to their homes, livelihood, or properties because of disasters like typhoons, earthquakes, or floods.

This loan is part of the SSS Short-Term Member Loans (STMLs), but it has special features that make it easier to pay back during hard times.

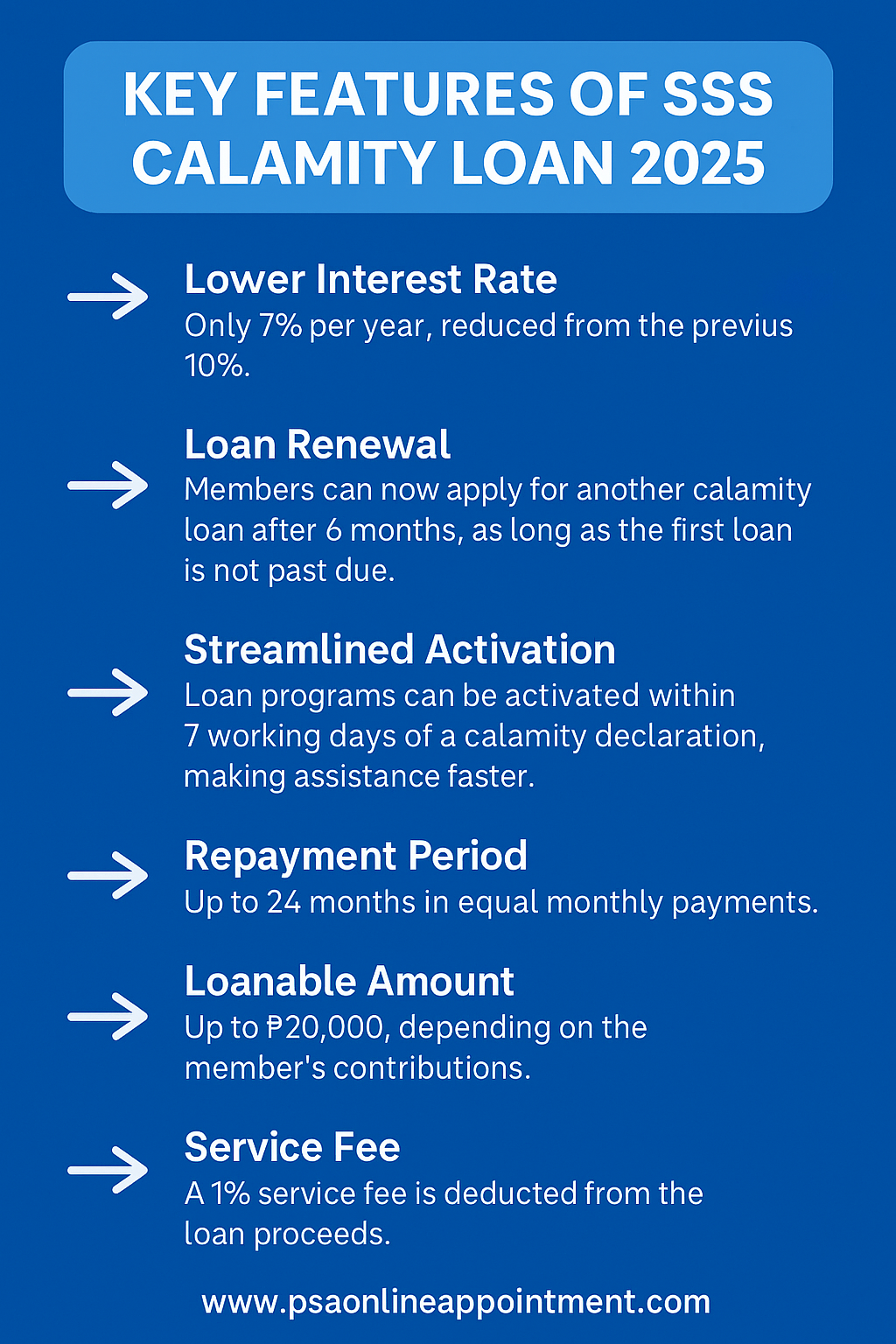

Key Features of SSS Calamity Loan 2025

- Lower Interest Rate: Only 7% per year, reduced from the previous 10%.

- Loan Renewal: Members can now apply for another calamity loan after 6 months, as long as the first loan is not past due.

- Streamlined Activation: Loan programs can be activated within 7 working days of a calamity declaration, making assistance faster.

- Repayment Period: Up to 24 months in equal monthly payments.

- Loanable Amount: Up to ₱20,000, depending on the member’s contributions.

- Service Fee: A 1% service fee is deducted from the loan proceeds.

Eligibility Criteria for SSS Calamity Loan 2025

To qualify for the SSS Calamity Loan in 2025, a member must meet the following requirements:

1. Membership and Contribution Requirements

- Must have at least 36 monthly contributions in total.

- At least 6 contributions should be posted within the last 12 months before applying.

- For self-employed, voluntary, or OFW members, at least 6 contributions must be under the current membership type.

2. Residency Requirement

- Must be a resident of an area declared under a state of calamity by the government.

- Must have suffered losses or damage to property in that calamity area.

3. Loan and Benefit Status

- Must have no past due SSS loans (like Salary Loan, previous Calamity Loan, or Loan Restructuring Program).

- Must not be a final benefits claimant (retired, permanently disabled, or already receiving total disability benefits).

4. Age Requirement

- Must be of legal age but below 65 years old at the time of loan application.

5. Employer Status (For Employed Members)

- Employer must be updated in contribution payments and loan remittances.

- Employer should also certify the loan application through the online system.

How to Apply for SSS Calamity Loan 2025

Applying for the SSS Calamity Loan is simple. Members can file applications online to avoid long lines at branches. Here are the steps:

Step 1: Register or Log in to My.SSS

- Visit the SSS website (www.sss.gov.ph).

- Log in to your My.SSS account.

- If you do not have an account, register first using your CRN or SSS number, valid email address, and personal details.

Step 2: Nominate a Disbursement Account

- Enroll a bank account or UMID-ATM card in the Disbursement Account Enrollment Module (DAEM).

- Only PESONet-accredited bank accounts are allowed. This is where the loan will be credited.

Step 3: Go to the Loan Application Tab

- In the My.SSS dashboard, click on the E-Services tab.

- Select Apply for Calamity Loan.

Step 4: Fill Out the Application Form

- Enter all required details, such as loan amount (if less than your eligible MSC).

- Review the terms and conditions carefully.

Step 5: Submit the Application

- Click Submit once details are confirmed.

- Wait for confirmation via email or SMS.

Step 6: Loan Disbursement

- Once approved, the loan will be credited to your nominated bank account or UMID-ATM within a few working days.

Loan Amount and Terms

The amount you can borrow under the SSS Calamity Loan depends on your contributions.

- Loanable Amount: Equivalent to one Monthly Salary Credit (MSC), based on the average of your last 12 MSCs, rounded up to the nearest ₱1,000.

- Maximum Loan: ₱20,000.

- Interest: 7% per year (on the unpaid principal).

- Repayment Period: 24 months (2 years).

- Start of Payment: Second month after loan approval.

- Penalty: 1% per month for missed amortization.

Responsibilities of the Borrower

- Repay on Time: Amortization must be paid monthly until the loan is fully settled.

- Update Employment Records: If you change jobs, the new employer must deduct and remit the loan amortizations.

- Maintain Active Contact Info: Update your email, phone number, and address with SSS.

- Avoid Default: If 6 amortizations remain unpaid, the loan will be tagged as default, and the entire balance will become due.

Why the 2025 Changes Are Important

The 2025 revised guidelines make the Calamity Loan more affordable and accessible:

- Lowering the interest rate from 10% to 7% reduces the burden on borrowers.

- Allowing renewal after 6 months provides ongoing support for members facing repeated disasters.

- Faster activation within 7 days ensures that help arrives when it is most needed.

These updates show that SSS is working to improve its loan services to match the real needs of its members.

Final Words

The SSS Calamity Loan 2025 is a vital support program for Filipino workers and families hit by natural disasters. With its lower interest rate, quicker activation, and easier renewal terms, it provides timely financial relief. By meeting the eligibility requirements and following the simple online application process, members can secure funds to help rebuild their lives after calamities.

For safe and quick access, always use the official SSS website or mobile app when applying for the Calamity Loan.

Frequently Asked Questions (FAQs)

1. Who can apply for the SSS Calamity Loan 2025?

Any active SSS member with at least 36 contributions, residing in a calamity-declared area, and with no past due loans can apply.

2. How much can I borrow under the Calamity Loan?

You can borrow up to ₱20,000, based on your monthly salary credit.

3. Can I renew my calamity loan?

Yes, starting 2025, renewal is allowed after 6 months, provided your loan is not past due.

4. How do I receive the loan proceeds?

Funds are released through your UMID-ATM card or your enrolled bank account under DAEM.

5. What happens if I fail to pay?

A penalty of 1% per month will be added. If unpaid for 6 months, the loan becomes default, and the full balance will be collected from your benefits.

One Comment